Excerpt from the Frederick News-Post:

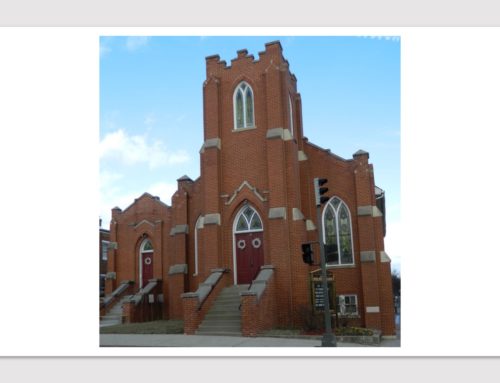

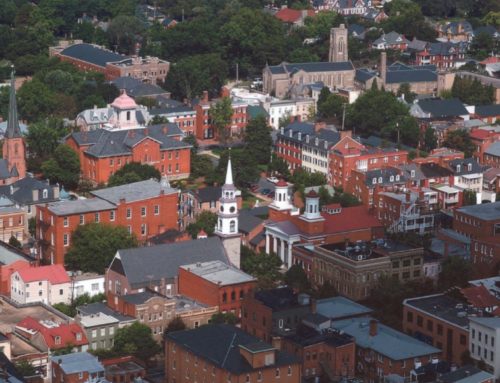

Owners of historic properties in the city of Frederick have until April 1 to apply for tax credits for completing qualified exterior repairs and renovations.

About a dozen people attended a Jan. 16 meeting where details of the city’s historic preservation tax credit program were explained. Historic preservation planners Lisa Mroszczyk Murphy and Christina Martinkosky explained that the city program, while two staff members from the Maryland Historical Trust explained details of a similar state program.

Through the city program, owners of properties in the Frederick Town Historic District and with historic preservation overlays are eligible to receive back 25 percent — up to $7,500 — of properly documented expenses related to exterior restorations. The work must cost a minimum of $500 — which Mroszczyk Murphy said is an easy amount to reach when doing work to historic properties — and includes various types of restoration, repair and rehabilitation work. Projects such as new masonry, storm doors and storm windows are eligible, while all interior work, utilities, landscaping, construction and demolition do not qualify.

The applications are due April 1 and apply to owners’ January 2018 tax bill. More information on the program is available at www.cityoffrederick.com/226/ Applictions-Fees-Tax- Credits.

Alderwoman Donna Kuzemchak, who serves as the aldermanic liaison on the city’s Historic Preservation Commission, reminded the public of the deadline at a workshop Wednesday and encouraged eligible property owners to take advantage of the program.

“If you fix the stuff in your house … please, please apply for the tax credit,” she said. “It’s up to 7,500 … that’s not just a small [amount].”

The state program the Maryland Historical Trust offers is similar to the city program by offering tax credits for eligible work. Homeowners with qualified projects are eligible to apply for credits from both programs, while commercial property owners can also apply for a separate commercial credit.

The state credit offers 20 percent of the eligible rehabilitation expenses back to the owners of three different types of properties: competitive commercial, small commercial and homes.

Preservation Officer Megan Klemm explained the details of each. She said the most common applicants are homeowners.

More information about the state program for homeowners is available at mht.maryland.gov/taxcredits _homeowner.shtml.